Electronic Check Processing

Increase cash flow, process payments faster, and give your customers more payment options with echeck processing.

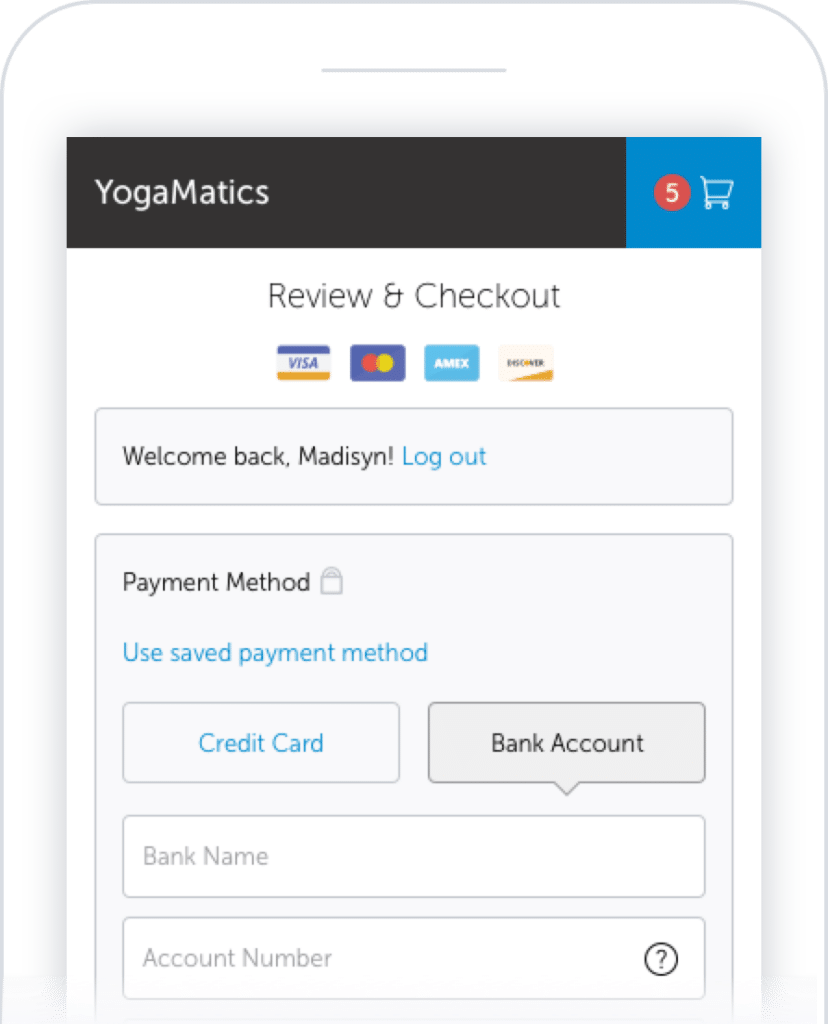

Accept eChecks Online

Provide the ultimate convenience to customers by accepting eCheck payments online.

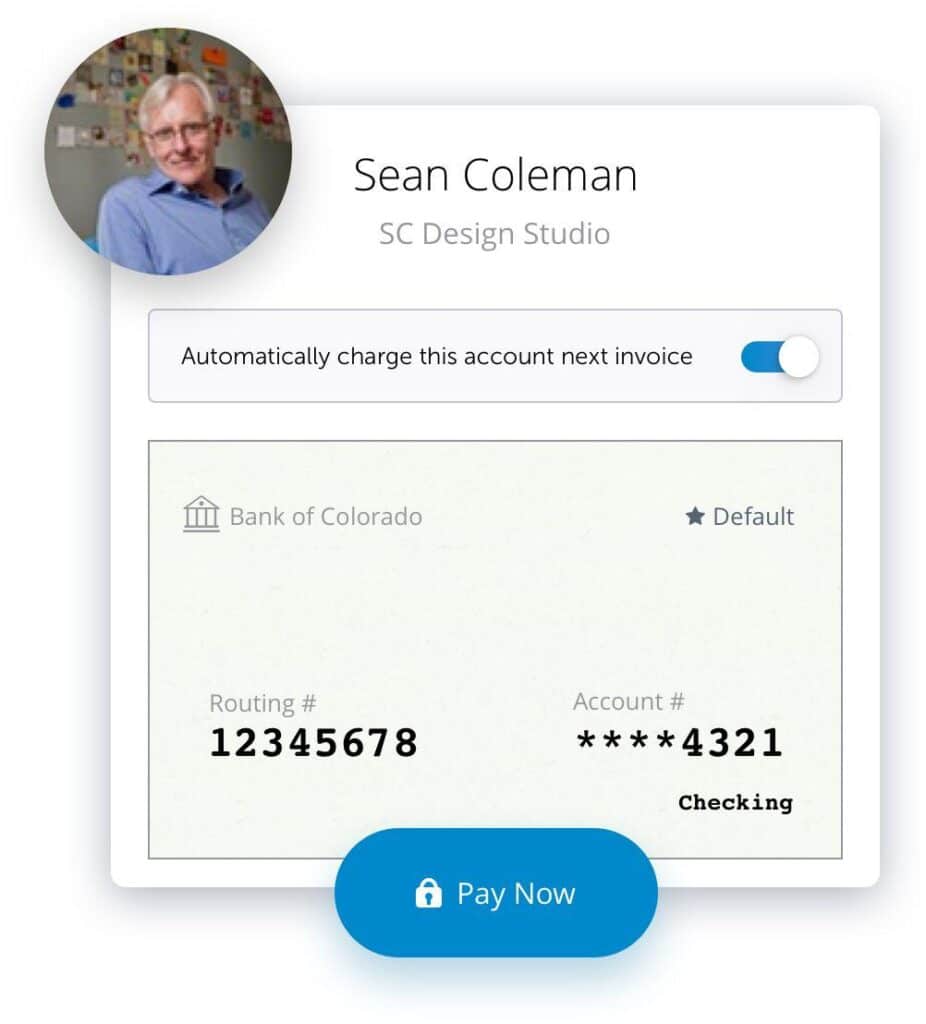

Secure Payment Data

All checks are processed through PaySimple’s secure eCheck payment gateway, ensuring your customer data is protected.

Get Paid Faster with eCheck Payment Processing

Stop waiting on checks in the mail, eliminate trips to the bank, and save on check processing fees when you accept echecks for both one-time and recurring payments.

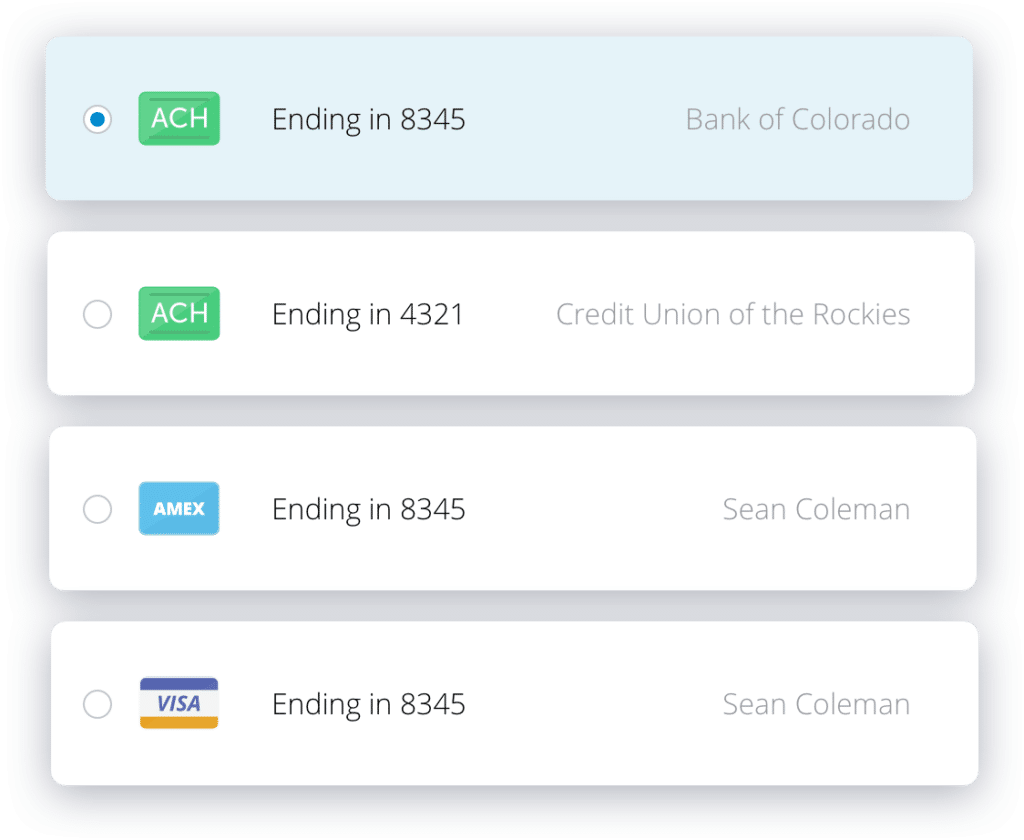

Accept Checks Online and Provide Convenience to Customers

Electronic checks give customers a payment option other than credit cards and on-file payment information make it easier for them to pay online, over the phone, or through a mobile device.

The Guide to Accepting ACH & eCheck Payments

Everything you need to know about safely accepting ACH and eCheck payments for your business.

Download Your Guide

Offer Secure Payment Processing with eChecks

Prevent fraud with top security safeguards and provide a secure payment option by limiting the handling of paper checks and transferring eCheck payments through secure ACH networks.

Save Money with eCheck Payment Processing

By accepting eChecks on some transactions, you can save money on processing fees associated with credit cards.